Here is your midweek jetpack of Amazon seller news, updates, and other useful clicks for your e-commerce business…

How to Set and Achieve your 2023 Sales Goals

It’s time to start planning for next year’s growth.

We created two posts to help:

Estimating, Projecting, and Achieving Sales Goals for Your Amazon FBA Business

This post breaks down the math behind the estimations.

Creating a Road Map for Achieving Gross Sales Goals for Your Amazon Business (+ Free Goal Template)

This post provides a spreadsheet and template for setting, tracking, and achieving your goals — plus a video on how to use the sheet.

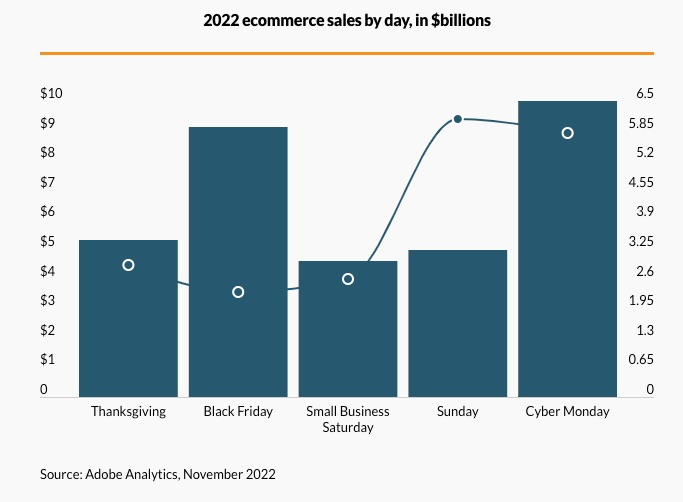

Cyber Week to Hit $35.27 Billion in Online Sales

Deep discounts and consumer demand made sweet, sweet love throughout Cyber Week as online sales hit $35.27 billion, up 4% from last year’s figures and accounting for 16.7% of all November and December sales.

With the supply chain disruption largely overcome, well-stocked retailers and sellers were able to offer larger discounts which drove demand up and triggered online spending to levels much higher than expected.

Key Takeaways:

- Cyber Week Online Sales by the Day:

- Thanksgiving – $5.29 billion

- Black Friday – $ 9.12 billion

- Weekend – $ 9.55 billion

- Cyber Monday – $11.3 billion

- Cyber Monday sales grew by 5.8% from the previous year.

- Cyber Week (5 day-period from Thanksgiving to Monday) sales grew by 4% from the previous year.

- Online discounting was up significantly with the average discount in the US being 30%.

- Categories with the highest discounts include general apparel (36%), active apparel and footwear (25%), and general footwear at 21%.

- “Buy Now, Pay later” orders increased by 85% and 88% in dollar terms compared to the prior week.

- Mobile devices accounted for 51% of sales this year.

- The average selling price increased by 8% in the US.

- “Socks” was the most searched term, with 48, 976 searches.

- Paid search remained the biggest driver of online sales (28% of all total orders) during Cyber Week.

This is great news after holiday sales expectations were tempered due to consumers being battered by inflation. Long live E-comm.

Check out more stats here.

Amazon Wins Online Price Wars, Still the Cheapest Online Retailer for the Sixth Straight Year

E-commerce analytics firm Profitero recently concluded a pricing study which declared Amazon as the cheapest online retailer for the sixth straight year.

According to the annual pricing study titled “Price Wars,” prices for products sold online are 13% cheaper on Amazon compared to the prices of leading US retailers across 15 product categories. Walmart placed second with prices at 6% higher than Amazon.

Read the full story here.

New Amazon Restrictions on Appliance Sales to California in 2023

Do you sell products in the appliances category?

In line with the requirements of the California Energy Commission, starting on February 6, 2023, Amazon will start to restrict the sale of products not registered to California’s MAEDbS (Modernized Appliance Efficiency Database System) in the following categories:

- Lightbulbs

- Pool Products & Portable Spa products

- Portable Air Conditioners

- Computers and Monitors

If your products aren’t registered to the MAEDbS, they will still be available for sale on Amazon, but won’t be available for sale in California until you get them registered.

View the full announcement here.

New Amazon Account Health Insurance Getting Mixed Reactions from Sellers

Does Amazon fancy the big sellers?

Holes are being poked into the eligibility criteria for Amazon’s Account Health Assurance (AHA) program which launched earlier this month.

The plan is being questioned by smaller sellers as the criteria for eligibility seems to favor high-volume sellers.

“To join Account Health Assurance, you need to maintain an AHR of 250+ for 6 months, with no more than 10 days below 250. This shows us that you take your account health seriously, and work quickly to fix policy violations,” says Amazon.

The problem is that a score of 250+ requires a super high velocity of sales (thousands of orders per month), and that isn’t really fair to third-party sellers at lower volumes who actually do take their account health seriously.

There should be no correlation between sales volume and “taking your account health seriously.”

We remain optimistic that this program will eventually benefit smaller but upstanding sellers. In this email, an Amazon spokesperson said that Amazon expects the benefit to include more sellers in the coming months. Fingers crossed.

See the open discussion on this thread.

What Should Amazon FBA Sellers Do After Christmas?

This blog post from AMZ Advisers gives you five things that you can do after Christmas to keep the sales trend up until the close of the year.

Keep an eye on new features like the Amazon influencer programs, as well as OG methods like RA and OA. The market provides constant opportunities if you are willing to learn and grow.

Other Quick Clicks

- How Amazon delivers to a remote island

- All you need to know about different types of Amazon Seller Badges

- Amazon’s inaugural “Products for Tomorrow” Awards spotlight sustainability-focused SMBs

- Black Friday Statistics 2022 – the top gifts sold on Amazon

- Amazon pushing envelope on warehouse automation

Thank you for reading. If you have any questions, comments or violent reactions, let us know below!

Get Your Quick Weekly Update on News and Resources for Amazon Sellers!

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.

About The Authors