Tariff Pressure Mounts: Chinese Sellers Grapple with Rising Costs on Amazon

China-based Amazon sellers are facing a rough new reality: US tariffs on certain Chinese imports have skyrocketed to a whopping 145%.

That kind of price hike is no joke, and it’s forcing many sellers to make a tough call: either raise their prices (and risk losing customers) or pull out of the US marketplace completely.

The added costs aren’t just about tariffs – they’re also dealing with US customs slowdowns and rising shipping costs, making doing business in the US way less profitable than it used to be. For a lot of these sellers, the math isn’t just mathing anymore.

In response, some are getting creative. A growing number are looking to expand into other markets like Europe, Canada, and Mexico, where the tariff pressure isn’t as intense. Others are exploring the option to shift manufacturing to countries like Vietnam or Mexico to dodge the steep import taxes.

For US sellers, the impact from the tariff hikes will be felt in a few key ways – and not all of them suck. With Chinese sellers pulling out, they may see less competition, especially in commodity categories, pricing volatility, product availability changes, and the rise of alternate manufacturers.

Read the full story here.

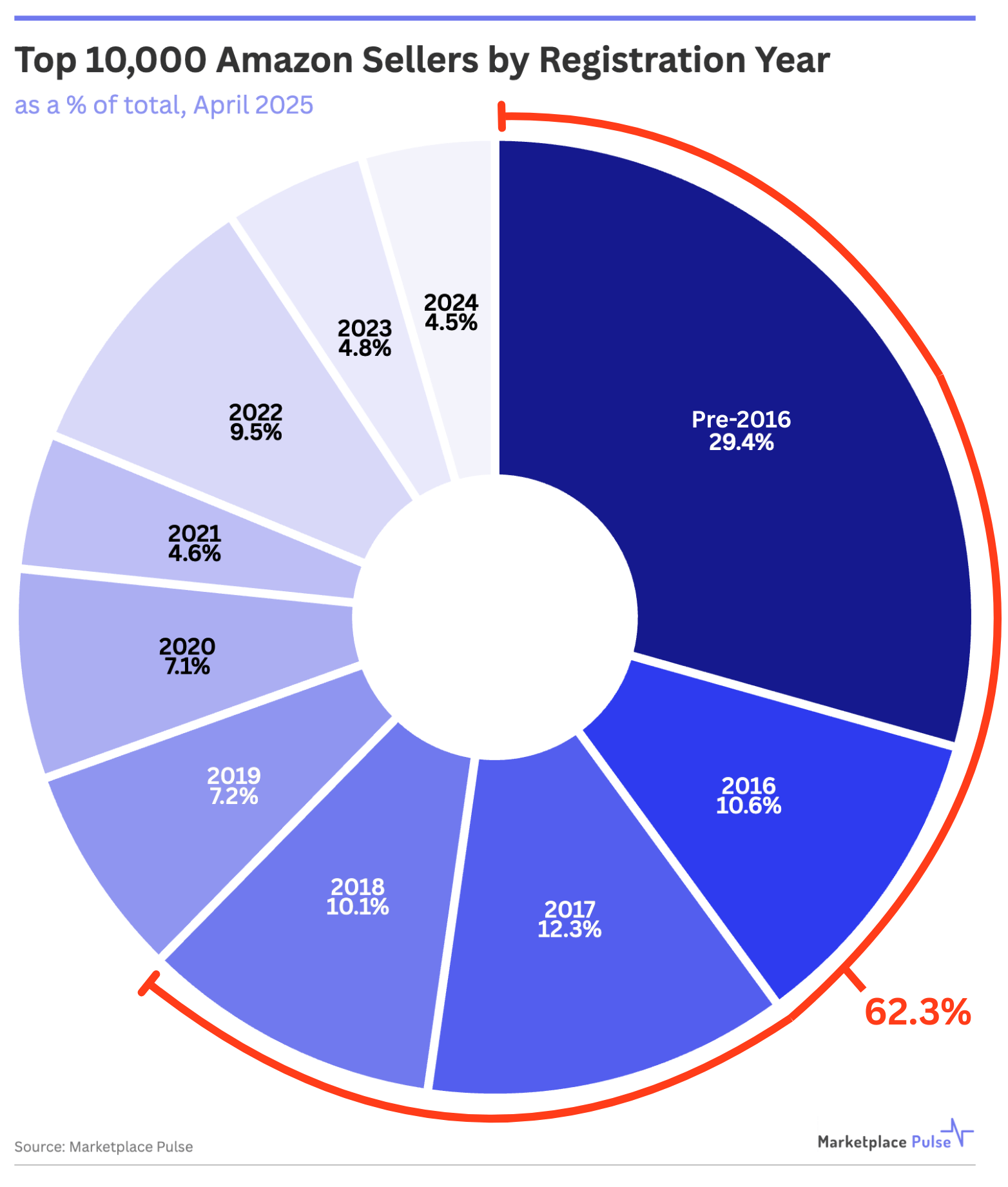

Seasoned Sellers Still Thriving—Here’s What New Sellers Can Learn

A recent deep dive by Marketplace Pulse says over 60% of top Amazon Sellers started before 2019.

Sound discouraging? Don’t bounce just yet – there’s a silver lining (actually a bunch of them):

- The Long Game Works – those veteran sellers? They didn’t just luck out. They stuck with it, learned, adapted, and kept improving. That’s great news – because YOU CAN DO THE SAME. Success on Amazon isn’t instant (no matter what those “gurus” say), but it’s absolutely buildable.

- Newbies Are Crushing It – almost 10% of top sellers started in the last two years. That proves new sellers can still rise fast, especially if they bring great branding, smart strategy, or simply a better way of doing things.

- Most People Quit – Don’t Be That Person – only 8% of pre-2019 sellers are still active. Why? A lot of folks jump in with no plan. Learn from that. Do your research. Build a game plan. Stick to it. The bar may be high, but it isn’t THAT high. Just don’t flake.

- Rising Costs? More Like Opportunity – yes, fees and ads cost more now. But that’s a push to get creative – build a brand, improve margins, and stand out with customer experience. Most sellers don’t do this. You should.

The Bottom Line:

The Marketplace Pulse data isn’t a warning—it’s a wake-up call. Learn from the crusty, battle-hardened vets. Stay flexible. Keep at it. You’ve got a wide open shot at building something real if you’re in it for more than just a quick buck.

Essential Amazon Seller Updates Fo Yo’ Bad Self

Clarification: Amazon Vine Policies on Review Aggregation and Review Limits – Amazon just rolled out some important updates and clarifications about how Vine reviews are handled, especially when it comes to review aggregation and merging ASINs.

Big Wins in Fight Against Counterfeits – in 2024, Amazon stepped up big to protect your brand. From seizing 15M+ fake products to stopping bad actors before they even list, Amazon’s 2024 Brand Protection Report breaks it all down.

Save the Date; Amazon Accelerate Takes Place September 16 – 18 – Amazon’s biggest seller event of the year is back – live in Seattle, September 16 – 18. Get a sneak peek at upcoming seller tools, connect with Amazon experts, and level up your business with exclusive insights and networking.

Amazon Checks in with Sellers as Tariff Drama Heats Up

Amazon is starting to take a more hands-on approach with sellers as tariffs and trade tensions heat up.

Lately, a bunch of sellers have been getting emails from their Amazon account managers asking for feedback on how these new tariffs are hitting their businesses. Amazon wants to know the real-world impact – things like whether sellers are seeing higher costs, having sourcing issues, changing product prices, or looking for suppliers outside China.

But it’s not just about gathering data. Amazon is also using this reach out to promote its European marketplaces. They’re suggesting sellers to consider expanding to Europe, where there’s a huge customer base and potentially some sweet perks to ease the transition.

The whole thing shows that Amazon is paying attention to the pressure sellers are currently under. With tariffs possibly making products more expensive to import and sell, Amazon seems to be trying to get ahead of the storm. Collecting seller insights might help them come up with new strategies or support tools to keep sellers from bailing – or at least to help them shift gears before things get worse.

Read the full story here.

Amazon Sellers Are Switching Up Their Marketing Game as Costs Keep Climbing

Amazon sellers are having to rethink their whole marketing game because of rising tariffs and higher fees to sell on the platform. On top of that, ads on Amazon are getting waaaay more expensive – Sponsored Product ad costs have jumped nearly 50% since 2019.

To deal with all this, sellers aren’t just pouring money into Search ads anymore. Instead, they’re getting creative – running Brand Awareness campaigns, teaming up with influencers, and driving traffic from places outside of Amazon. It’s all about building a real brand so they’re not stuck relying only on Amazon’s pricey system.

Basically, they’re trying to stretch their ad dollars further and keep making sales without going broke. With Amazon’s ad business booming, sellers are being forced to find smarter, more efficient ways to stay in the game.

Read the full story here.

OA News, Tips, & Tricks

Section 3 Suspension Guide – Chris’ Grant’s Section 3 Suspension Guide has helped a good number of sellers recover their suspended accounts. Watch the video here.

Make Better Inventory Decisions with Keepa – Keepa is a must-have tool for Amazon resellers, but few understand its limitations. This pod episode discusses just that, and will help prevent you from making false assumptions based on the data Keepa provides.

Volume Vs Profit – should you be focusing on volume or profit? This post on X gives a great breakdown on what actually is more beneficial for your business.

Easily Answer Amazon Documentation Requests – this post on X shares automation methods which makes collecting invoices you need to answer Amazon documentation requests easy-peasy.

Cross-Border Flipping – Trump’s tariffs may present an interesting opportunity for resellers – cross-border flipping. This post on X explains what it is and how you can implement this strategy in your Amazon reselling business.

This Week in Seller School

Blog Posts

- Gift Guides for Mothers’ Day: The Role of Product Bundles in Boosting Sales by Seller Snap

- Amazon Tariffs Update with Free Calculator by Carbon 6

- Amazon Increased Coupon and Deal Fees Effective June 2, 2025 (What Sellers Need to Know) by NivoAds

- Amazon Restock Limits are BACK in 2025 – Now what? by Marketplace Prep

Podcasts

- 5 Shocking Consumer Trends that Amazon Sellers Can’t Ignore by The Seller’s Edge Podcast

Other Quick Clicks

- Amazon Haul is changing due to Trump tariffs – new focus to sell products from US warehouses

- Why is Amazon sniffing around TikTok?

- Amazon’s AI shopping agents: The most brilliant power play in retail this year

- The future of AI and robotics is being led by Amazon’s next gen warehouses

- As beauty continues to grow, TikTok Shop and Amazon will gain share

Thank you for reading. If you have any questions, comments or violent reactions, let us know below!

Meme of the week comes from @fieldsofprofit

Get Your Quick Weekly Update on News and Resources for Amazon Sellers!

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.

About The Authors