Here is your midweek jetpack of Amazon seller news, updates, and other useful clicks for your e-commerce business…

2023 US Online Holiday Sales Stats Nerd Out

Here are some key points from the Adobe online shopping forecast for November and December 2023:

- US online holiday sales are predicted to reach $221.8 billion, a 4.8% YoY increase. The previous year saw $211.7 billion, up 3.5% YoY.

- Cyber Week will contribute $37.2 billion, a 5.4% rise. This includes a record-breaking Cyber Monday with $12 billion sales.

- Black Friday and Thanksgiving online sales are projected at $9.6 billion (up 5.7%) and $5.6 billion (up 5.5%) respectively.

- “Buy Now, Pay Later” spending is forecasted at $17 billion, a 16.9% rise, with Cyber Monday hitting $782 million, surpassing the prior year’s $658 million.

- Leading product sales include electronics ($49.9 billion), apparel ($41 billion), and furniture/home goods ($26.6 billion).

- Mobile device shopping will account for 51.2% of purchases, overtaking computers for the first time.

- Nearly half (49%) plan to begin holiday shopping in October.

You this Q4:

Clothing & Shoes to Crush this Q4

We just wanna get you pumped with more holiday sales hype…

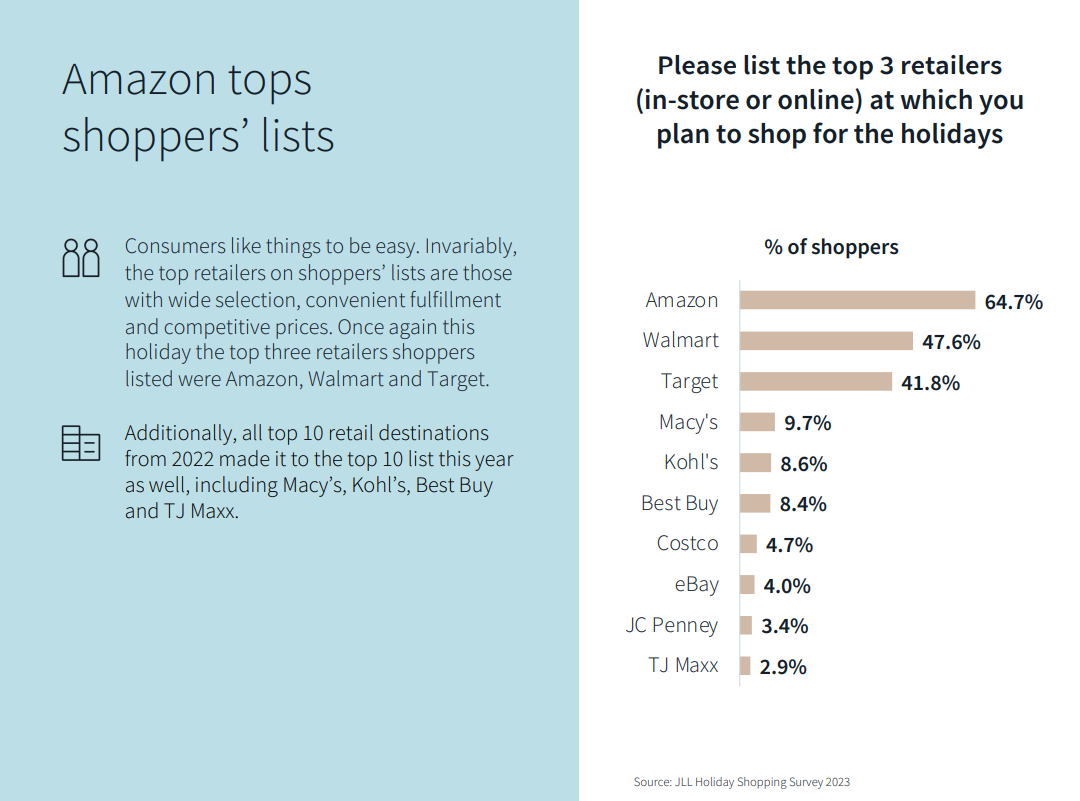

According to another stat nerd survey, Amazon (64.7%), Walmart (47.6%), and Target (41.8%) are the top 3 holiday shopping destinations for shoppers this year– by a long shot.

Here are some more stats:

- Average spend: $958 per person.

- Women to outspend men by 40%. Older generations spend more than the younger ones.

- 76.6% will shop online.

- Top platforms for shopping inspiration: Meta (35.8%), Instagram (32.7%), and YouTube (24.1%).

- Top 5 gift categories:

- Clothing/Shoes (57.5%)

- Gift Cards (45.9%)

- Toys (39.2%)

- Games (38.5%)

- Electronics (37.3%)

- Top 5 self-purchase categories:

- Clothing/Shoes (47.1%)

- Electronics (30.5%)

- Accessories (24.9%)

- None (23.8%)

- Cosmetic/Beauty (17.3%)

- Key brands for kids: Super Mario Brothers, Little Mermaid, Barbie, Star Wars, Toy Story, Sonic, Gabby’s Dollhouse, Lego, Hot Wheels, Roblox, Xbox.

*Clothing and shoes continue to crush, despite inflation.*

Download the whole survey here for more insights.

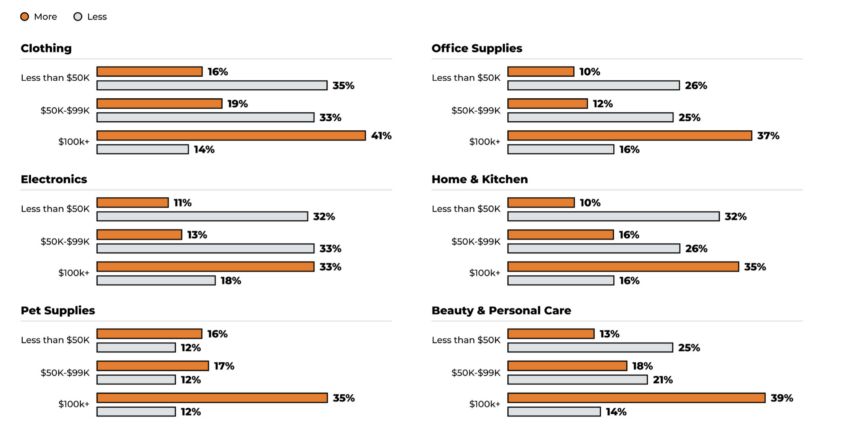

How Consumers at Different Income Levels Spend

Jungle Scout released a new robust report on the spending behaviors of consumers at different income levels in Q3.

- Low-income earners: Less than $50k

- Middle-income earners: $50k to $99k

- High-income earners: $100k+

Here is our best summary:

- Amazon’s Dominance: 65% of all respondents favor Amazon as their go-to online store. However, middle and high income earners lean more towards Amazon than their low-income counterparts.

- Brick-and-Mortar: Walmart and Target lead as preferred in-store shopping destinations across all income brackets.

High-Income Consumer Behavior:

- Amazon Badges: 50% prioritize badges like ‘Climate Pledge Friendly’ and ‘Small Business’, in contrast to 23% of sub-$50K earners.

- Early Bird Shopping: 44% of high-income earners initiate their holiday shopping before September.

- Spending Trends: Despite inflation, 42% upped their Q3 spending from Q2, with 54% raising online expenditures.

- Search Preferences: 41% of high earners start their product hunts on social media, especially Facebook.

- Frequency: A third of high-income shoppers buy online daily, compared to 57% of all consumers shopping online weekly.

Inflation’s Grip:

- 79% attest to inflation influencing their Q3 spending.

- 66% express financial anxieties.

- 47% find their household income unpredictable.

Income and Spending Dynamics:

- 41% of low-income earners reduced their spending.

- Half of middle earners maintained their spending status quo.

- 42% of high earners and 24% of mid-to-low earners increased online spending.

Product Preferences:

- 41% of high earners bought more clothing in Q3 than Q2, versus 16% of those earning below $50K.

- High-income earners also favored beauty products (39%) and pet supplies (35%), considerably more than other income brackets.

Image from JungleScout report

Dive into the full Q3 2023 Consumer Trends Report.

Considering Amazon Marketplace Alternatives?

Amazon has been the e-commerce giant for a while, but several players are aiming to share the spotlight and offer third-party sellers new outlets for growing their business.

Let’s size up the competition:

- Temu & Shein: Their calling card? Unbelievably low prices. They’ve grabbed the attention of many budget-conscious shoppers, but the reliability of their delivery services remain in question. May be a tough place for resellers to thrive due to the prices. It may work great for brands.

- TikTok: It’s got a colossal user base, but the US market is still warming up to their live stream shopping model (though it keeps growing.) Again, probably hard for resellers and potentially huge for brands.

- Walmart: Currently the most potent rival to Amazon. With 100K active sellers and a fast-growing fulfillment network, Walmart is making huge strides. Depending on how pricing evolves with third-party products being listed, this could be great for resellers and brands.

All opportunity is worth considering. Think back to the first few sellers who joined Amazon. Such a wild ride!

Read the full story here.

AI Caramba! This Week in AI + Ecomm

- Amazon Introducing a Search Concierge in January 2024: Amazon is launching Project Nile, its search concierge, in January 2024. It will offer expert answers, instant product comparisons, additional product details and reviews, and product suggestions based on search context and personal shopping data.

- Walmart Looks to AI to Optimize Search and Customer Experience: Walmart is currently testing a number of generative AI-powered search and shopping features, including a new search tool that rivals Amazon’s Project Nile features.

Important Amazon Updates for Yo’ Bad Seller Self

New Features Added to the FBA Returns Dashboard

The FBA Returns dashboard, which provides an overview of all product return information, has been improved.

It will now give you insights into return trends like:

- Most-returned products and key return reasons

- Returns insights by product

- Customizable reports on return trends

Click here to try out the new features of the Return Insights tab.

Lower-priced Fee Tiers for Amazon Vine

Amazon will be introducing a new pricing structure for Amazon Vine on October 19, 2023. The new pricing structure will make Amazon’s review program more accessible to brands with varied budgets and products.

The new tiers are:

- $0 (new tier) – enroll up to 2 units per parent ASIN and get up to two quality Vine reviews for free

- $75 (new tier) – enroll up to 10 units per parent ASIN and get up to 10 Vine reviews

- $200 (existing tier) – enroll up to 30 units per parent ASIN and get up to 30 Vine reviews

Amazon Seller Wallet: New Features and October Promo

The Amazon Seller Wallet has been updated with a new feature that will allow users to pay third-party vendors and suppliers directly from Seller Central, helping global sellers save on conversion fees and minimize losses when using USD proceeds for USD-based business expenses.

Exclusive Seller Control for Generic Product Listings?

According to a surprising Amazon announcement, Sellers who create a new product listing under the brand name “Generic” will now have exclusive control over any edits made to the product listing, as per Amazon’s listing policy. Other sellers will not be able to edit or make changes to the listing, and will also not be able to copy the product to their stores.

Amazon says “If you try to edit or add offers on another seller’s generic product, you’ll receive an error message in feeds or in the one-to-one listing process. You will then be guided to create a new product in the Add a Product tool.”

See seller reactions here.

A/B Tests for Supporting Images Now Enabled

You can now run A/B tests on your products’ supporting images (lifestyle imagery, various product angles, product properties, specification lists, and videos) in the Manage Your Experiments dashboard.

Click here to learn how to increase conversions with images that resonate with your customers.

This Week in Seller School

Blog Posts

- What to Sell on Amazon FBA in Q4 2023 by Jungle Scout

- Week by Week Q4 Success Guide for Amazon Sellers by eStore Factory

- Amazon Lost Inventory: How to File a Reimbursement Claim by Online Seller Solutions

Free Downloads

- The Latest in Ecommerce Consumer Behavior Trends by Feedvisor

Podcasts

- Optimization Hacks Don’t Work, and What You Should Do Instead by Seller Performance Solutions

- How to Master Your Amazon FBA Reselling Skills by Full-Time FBA

Upcoming Seller Events📍

Here are a few upcoming industry events that you might be interested in. Slick that hair back and start mingling, playa!

Amazon Ads Webinar: Tips for Optimizing Your Keywords Strategy (October 17, 2023, 10:00 PM CST) – Virtual

Learn how to get the most out of your campaigns by finding, choosing, and using keywords more effectively.

Amazon Ads Unboxed (October 24-26, 2023) – New York City, NY

Learn about Amazon’s newest solutions and innovations to help brands connect with their customers, expand their business, and prepare for the future.

Seller Alliance Summit (October 27-28, 2023) – Toronto, Canada

Get the latest growth strategies from world-class experts to turbo charge your Amazon sales.

Amazon Ads Webinar: How to Optimize Your Stores to Captivate Shoppers (November 1, 2023,12:00 AM) – CST, Virtual

Go beyond the basics of store creation and explore how to maximize the impact of your Amazon store.

Eclimb Summit (November 2, 2023) – Austin, TX

“Bridge the gap between Amazon and Ecomm for D2C.”

AMZ Innovate (November 13-14, 2023) – New York City, NY

Nashville eCommerce Summit (December 12, 2023) – Nashville, TN

“A one-day gathering of local eCommerce experts and decision-makers across retailers, brands, merchants, and solutions providers.

Other Quick Clicks

- The most popular Halloween costumes of 2023 (and how you can sell them on Amazon)

- Amazon Market Watch: After the Victoria’s Secret Tour ‘23 Premiere, sales of products grow by 1,000%+

- Uber gets in on ecommerce product returns

- Can Amazon’s fulfillment efforts eliminate holiday delays?

Thank you for reading. If you have any questions, comments or violent reactions, let us know below!

Get Your Quick Weekly Update on News and Resources for Amazon Sellers!

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.

About The Authors