Here is your midweek jetpack of Amazon seller news, updates, and other useful clicks for your e-commerce business…

Amazon Offering Incentives for New Sellers and Expanding Marketplace Sellers

Amazon is offering new sellers and existing sellers who are expanding to select marketplaces (including UK, Germany, France, Italy, Spain, and Japan) a suite of incentives that can be worth over $50K.

The New Seller Incentives program offers a variety of handsome benefits to new sellers identified as brand owners with Amazon brand registry and new sellers who use FBA, Sponsored products, and Amazon coupons.

Benefits include:

For new sellers identified as brand owners with Amazon Brand Registry

- A 5% bonus on up to $1 M in sales or for one year after eligibility is determined

- $200 credits in Amazon Vine

For new sellers who use FBA:

- $100 in credits in inventory shipping fees for using the Amazon Partnered Carrier Program or $200 in credits in fulfillment fees for using Amazon Global Logistics

- Automatic enrollment in FBA New Selection

For new sellers who use Sponsored Products:

- $50 in promotional clicks for using Sponsored Products.

For new sellers who use Amazon Coupons:

- $50 in coupon credits.

If you’re a new seller, or a seller planning to expand to the aforementioned international marketplaces, this is most definitely an opportunity worth exploring. You can learn everything about the New Seller Incentives Program here.

Effects of Recession and Inflation on Amazon Sales in 2022

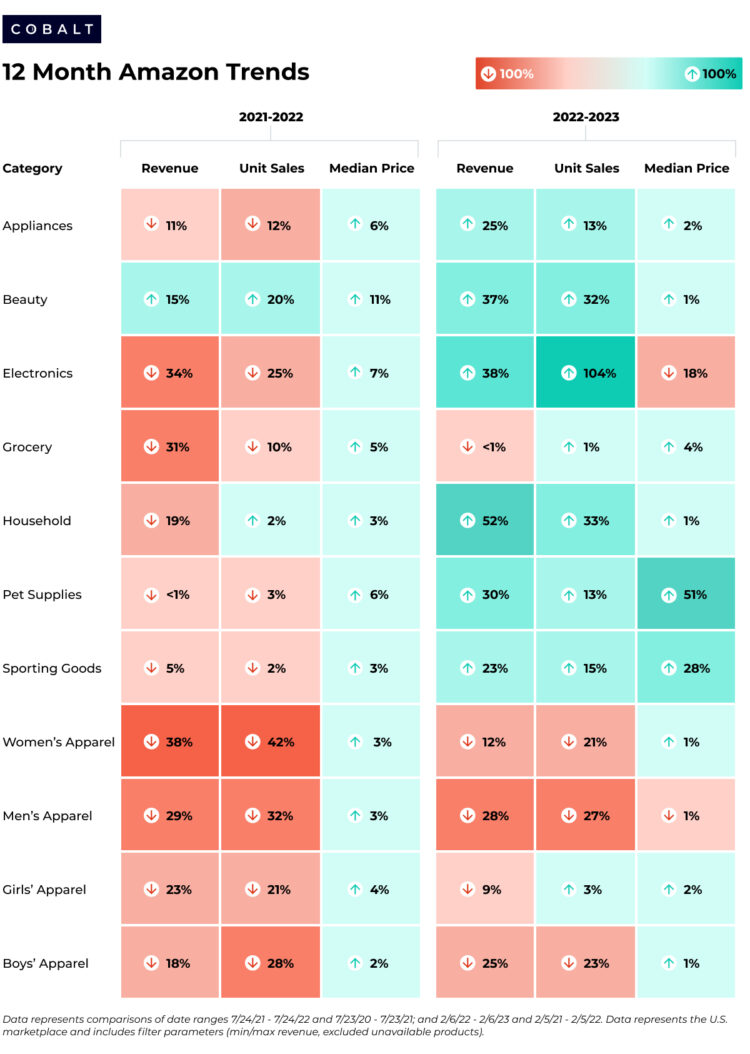

Data from Jungle Scout Cobalt, an industry-leading market intelligence and product insights platform, reveals how record inflation and the recession has altered the shopping habits of consumers on Amazon in 2022.

(image from the report on JungleScout.com)

So how exactly is the recession impacting sales in various Amazon categories? Here are some key takeaways from the JS Cobalt Data:

- Apparel and Jewelry had the largest decline in sales and revenue. 26% of consumers reported buying less clothing in Q4 compared to Q3. Clothing, Shoes, and Jewelry had a 33% year-over-year decline in revenue and 30% decline in sales.

- Health and Household had the largest revenue growth, mainly due to a majority of consumers maintaining or even increasing their spending in Health and Household subcategories such as cleaning supplies, vitamins, and dietary supplements. Also worth noting is the positive reaction consumers have for eco-friendly, reusable, and natural Health and Household products.

- With its 104% increase in unit sales, Electronics had the largest sales growth in 2022. A part of this growth can be attributed to the fact that this category also experienced the largest median price drop – a decrease of almost 20% in Q4.

- Pet Supplies had the largest median price increase in 2022, recording a median price increase of over 50%. With people placing their pets as among their top priorities, sales in this category grew year-over-year.

Understanding the impact of the recession will be one of the keys to having a successful 2023. Make sure to read the full article from Jungle Scout here, as author LeeAnn Whittmore also imparts strategies that can help you respond to recession and inflation.

A Comprehensive Analysis of Amazon’s Target Market

This blog post from Gorilla ROI is dense and incredible.

Understanding Amazon’s target market is one of the best ways to uncover profitable selling opportunities.

The analysis dissects every facet of Amazon’s targeting methods—through categories, spending habits, and algorithmic impact—and explains in detail how you, as a seller, can leverage the data available to grow your business.

Important Amazon Updates

Some important things to take note of:

- Meltable inventory in Amazon fulfillment centers will be removed and disposed of for a fee starting April 15, 2023. If you don’t want your inventory to be disposed of, make sure to create removal orders for them before the said date. If you aren’t sure about what Amazon classifies as “meltable” read this Help Page.

- Fulfillment fee changes to take note of:

- Off-peak monthly surcharges for standard-sized products increased last February 1. These changes will be reflected in March 2023 charges for storage that occurs in February 2023.

-

- Beginning April 15, 2023, Amazon will make changes to the aged inventory surcharge for inventory stored between 271 to 365 days.

- There are new fees for inventory aged between 181 to 270 days for all products EXCEPT those in the Clothing, Shoes, Bags, Jewelry, and Watches category will be introduced.

- Amazon will also continue to charge an aged inventory surcharge for units stored for more than 365 days.

Learning Opportunities this Week

Here is a weekly roundup of learning resources:

Blog Posts:

- Avoid Selling These Amazon Restricted Brands by Saving K

- 5 Amazon Advertising Features You May Not Know About by eComEngine

- Making the Most of Amazon’s Buy Box Algorithm by AMZ One Step

- Amazon’s Choice Badge: Everything You Need to Know by eStore Factory

- Top Amazon Product Categories by Jungle Scout

Youtube:

- Avoid This Mistake When Filing Your Taxes in 2023 by Jungle Scout

Podcasts:

- Revolutionizing Amazon Seller Financing: Game-Changing Innovations for Growth with Don Henig by AM/PM Podcast

- Top 2 Secrets for Finding More Inventory to Sell on Amazon by Full-Time FBA Podcast

Other Quick Clicks

- Amazon reigns supreme in brand power for entertainment apps

- Amazon CEO reaffirms commitment to grocery business despite closures

- FTC charges company for review hijacking on Amazon

- 5 areas where Amazon is increasing its healthcare investments

- These home upgrades have super high Amazon reviews because they’re so cheap and look so good

Thank you for reading. If you have any questions, comments or violent reactions, let us know below!

Get Your Quick Weekly Update on News and Resources for Amazon Sellers!

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.

About The Authors