Here is your midweek jetpack of Amazon seller news, updates, and other useful clicks for your e-commerce business…

Amazon Snags 17.7% of Cyber Weekend Sales

Amazon captured almost $1 for every $5 spent across e-commerce platforms during the Cyber Weekend madness sales. Amazon’s total market share peaked at 17.7%, a significant jump from its previous 10.1% share in the last year.

A few noteworthy stats:

- Walmart was the runner-up, earning 14% market share. Other top-performing retailers include Costco (3.8%), Kroger (3.7%), and Target (3.4%).

- Top Gifting Categories: Apparel (67%), Toys/Games (52%), Electronics (45%), and Home Goods (44%).

- Nearly two-thirds of Amazon shoppers made more than one order on the website over the weekend and spent on average $31.49 per item.

Read the full story here.

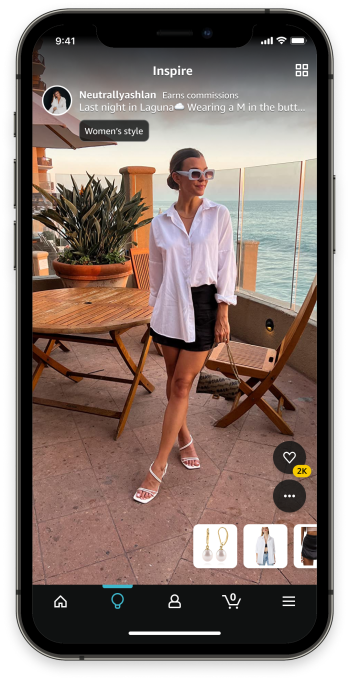

Amazon Barges into Social Commerce Market, Launches “Inspire”

Watch out Tiktok, there’s a new gunslinger in town…

Amazon has officially thrown its hat in the social commerce ring as it launched “Inspire”, a Tiktok/Instagram-like shopping feed that supports short-form videos and photos. Like Tiktok, Inspire enables shoppers to explore products and ideas, as well as shop from content created by influencers, brands and other customers.

This new shopping feature, which intends to drive sales to Amazon.com, is now available to select US customers, and will become more broadly available in the months to follow.

If this thing is even a fraction as addicting as TikTok to consumers, it’s scary to think how much it will increase shopping habits, online sales, and aggressive scrolling at family events.

Read the full store here.

Image credit: Amazon

Amazon Sponsored Ads 2022 Updates

Amazon really beefed up its advertising platform this year, adding features to help sellers and vendors strengthen their brand presence and increase sales on the marketplace.

These upgrades compliment the advertising segments of sponsored products, sponsored brands, sponsored display, and the live Amazon marketing stream.

Check out the details in this recap from eCommerce Nurse.

The Curious Case of Missing FBA Inventory

More sellers are starting to complain about how increasingly difficult it is to track down their missing FBA inventory. Sellers have identified two key issues: either Amazon is not showing shipments as received or inventory suddenly goes missing after being declared received.

In this thread, there is an ongoing discussion about issues with reimbursements and missing inventory. One seller reported that after their shipment was received and declared by Amazon as having no discrepancies, 85% of the inventory just disappeared after nine days. Sales from the shipment were canceled, and Amazon just closed the shipment.

Are sellers just misinterpreting the inventory reports? There is an explanation in this thread that supports the possibility. In the same thread, an Amazon mod posted this reply about receiving centers:

“The escalation team confirmed: Inventory is initially received at a location which is only used as a “Receive center”, these receiving centers do not ship out to customers, which is why later on there is another – negative transaction to record that a certain amount of units will be moved to another Fulfillment center. This is not quite the same as warehouse transfers transactions since this only happens between regular FCs. The “Receive centers” are used as an intermediate between the Vendor/Sellers and actual Fulfillment centers to have a better sorting method and to have a better inventory distribution amongst all FCs, the main purpose is to maintain customer demand. As explained by VTR this should later be received at the destination FCs, ultimately, the negative transaction is used to record every movement of the inventory since its first received.

NOTE: Inventory movements can take days if not weeks. Sellers are encouraged to wait for the eligible date of reconciliation of each shipment if they have concerned that the inventory is lost.

Reconcile your shipment: here”

It does feel like the missing inventory and reimbursement issues are getting worse (or at least taking longer to resolve) — but Amazon has also shown a solid increase in seller support over the past year. Are more improvements on the way?

Learning Opportunities: Kickstart 2023 Edition

It’s never too early to start planning Amazon FBA domination for 2023! Here’s quick roundup of excellent learning resources from this week:

- Podcast – 8 Tips for Amazon Inventory Management in 2023 on Episode 104 of The Next Amazon Top Seller Podcast

- Reddit – Getting Rid of Stale Inventory in Amazon FBA

- Blog Post – 2023 FBA Holiday Calendar & Checklist: Key Dates for Amazon Sellers by Supply Kick

- Blog Post – The Six Steps to Sales Tax Compliance in 2023 by TaxJar

- Blog Post – The Top 9 Ways to Use Your Q4 Income Wisely by Full-time FBA

Other Quick Clicks

- Black Friday and Cyber Monday Statistics 2022 – the top gifts sold on Amazon

- Amazon adds option for obtaining Sustainability Badge

- How Amazon makes machine-learning trustworthy

- Amazon seeks to remove barcodes from inventory tracking

Thank you for reading. If you have any questions, comments or violent reactions, let us know below!

Get Your Quick Weekly Update on News and Resources for Amazon Sellers!

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.

About The Authors